ROVI distributes dividends of 48 million euros and approves all the items on the agenda at its General Shareholders’ Meeting by a wide margin

Wed, 18/06/2025 - 00:00

5 minROVI distributes dividends of 48 million euros and approves all the items on the agenda at its General Shareholders’ Meeting by a wide margin

_b0a7341.jpg

Madrid, 18 June 2025. This Wednesday, Laboratorios Farmacéuticos Rovi, S.A. (hereinafter, “ROVI” or the “Company”) held its Ordinary General Shareholders’ Meeting, at which all the items on the agenda were approved, including the annual accounts for 2024 and the shareholder remuneration via dividend. Specifically, the Meeting, which reached a quorum on the first call, approved the distribution of a dividend of 0.9351 euros per share entitled to receive it, equivalent to a maximum of 47,910,561.05 euros, charged to the 2024 profit, representing a pay-out of 35% of ROVI’s consolidated net profit.

This remuneration falls within the framework of a broader strategy aimed to increase the creation of value for ROVI shareholders. Thus, in June 2024, ROVI completed its third buyback programme, through which it acquired a total of 2,233,466 treasury shares for a total amount of 130 million euros, representing 4.13% of its share capital at that time. This operation culminated in September 2024 with the cancellation of 2,780,395 shares, including both the shares acquired under the aforementioned buyback programme and other treasury shares held by the Company, with the corresponding decrease in the share capital, the number of shares dropping to 51,235,762. Since November 2021, ROVI has allocated a total of over 300 million euros to the execution of three buyback programmes. The main objective has been to redeem treasury shares through capital reductions, which has contributed to an increase in earnings per share and, consequently, shareholder remuneration.

The 2025 General Shareholders’ Meeting, held this Wednesday, was attended by 397 shareholders, both present and represented, holding a total of 44,104,081 shares, accounting for 86.081% of the Company’s share capital. The strong support received at the Meeting reflects the shareholders’ confidence in the current management team and the Company’s long-term growth strategy, with special focus on internationalisation, driving the contract manufacturing business (CDMO) forward and promoting innovation and the development of own products using the ISM® technology, such as Okedi® (Risperidone ISM®).

Regarding the approval of the items on the Agenda, the shareholders approved the 2024 accounts, with consolidated operating revenue of 763.7 million euros in the year, 7.9% lower than in 2023, mainly due to the behaviour of the contract manufacturing division. Notwithstanding, the Company achieved a 3.7 percentage point increase in the gross margin, which rose to 62.7% as a result of a heavy increase in the sales of Okedi® (Risperidone ISM®), which contributed high margins, a higher contribution to the CDMO business from existing customers (excluding Moderna), which also furnished high margins, and a lower contribution to the CDMO business of the activities carried out to prepare the plant for medicine production under the agreement with Moderna.

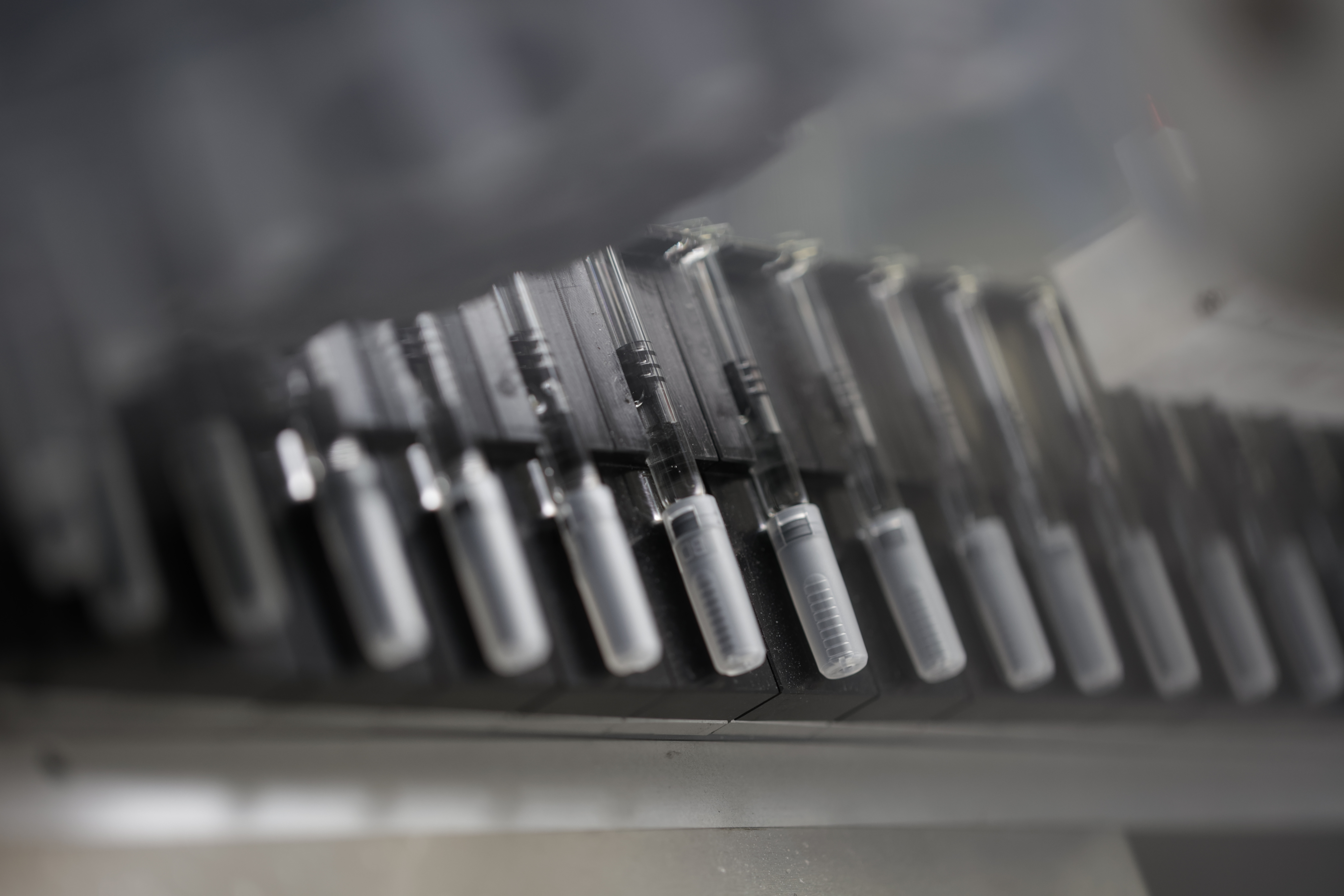

Mr Juan López-Belmonte Encina said: “2024 was a key year of transition in laying the foundations for our future. We focused on strengthening our capacity in the contract manufacturing area to address the imbalance between the growing demand and the limited supply of production capacities for injectables. The expansion of our production capacities places us in a favourable position to meet global market needs. Furthermore, Risperidone ISM® showed efficacy in treating schizophrenia with positive results that are reflected in an improvement in the patients’ quality of life. We are continuing to invest in research and development, taking advantage of the capabilities of our ISM® technology to provide innovative solutions that drive the well-being of society forward and help medicine to advance.”

Long-term growth strategy

The support of the Meeting reinforces the Company’s current long-term growth strategy. The Company forecasts its operating revenue will increase by between 1.5x and 1.8x by 2030. At present, ROVI is investing to expand its contract manufacturing business capacities to address the current global imbalance between supply and demand in this market. Specifically, it expects group sales to be driven primarily by the contract manufacturing business, which is forecast to double its sales to approximately 700 million euros by 2030.

At the same time, ROVI continues promoting its specialty pharmaceutical business, with a low-single-digit compound annual growth in revenue forecast for the period 2024 to 2030. The main growth driver will be Okedi® (Risperidone ISM®), the first product based on ISM® technology. ROVI expects to reinforce its internationalisation and reach potential sales of this product of between 100 and 200 million euros globally in upcoming years. The objective is for ROVI to become a significant world player in the field of long-acting injectables to treat schizophrenia.

In terms of profitability, ROVI forecasts that its EBITDA before R&D costs in 2030 will be between 2.5x and 2.8x the 2024 figure, driven by an improvement in the operating margins over the next six years. To sustain its innovative product portfolio, the Company plans an average annual investment of between 40 and 60 million euros in research and development over the next six years (2024 to 2030, inclusive).

ISM® technological platform

ROVI is developing two innovative formulations based on its ISM® technological platform: Letrozole SIE, a quarterly long-acting injection of letrozole, which is superior to Femara® in oestrogen suppression, for the treatment of hormone-dependent breast cancer, and Risperidone QUAR®, a quarterly prolonged-release injection of risperidone to treat schizophrenia in adults, which allows adequate plasma levels to be obtained as of the injection date. Both products seek to enhance clinical efficiency, increase treatment adherence and furnish an enhanced tolerability profile.

In the first quarter of 2025, ROVI obtained favourable results in both phase I clinical trials, enabling it to progress to the phase III trials. These developments reflect ROVI’s commitment to innovation and improving the patients’ quality of life.

R&D&I grants

In 2025, ROVI will receive a grant of 37.1 million euros from the Technological Development and Innovation Centre (CDTI) for development of the project IPCEI – LAISOLID within the framework of the Recovery, Transformation and Resilience Plan funded by the European Union. This project falls within the Important Project of Common European Interest Med4Cure, focused on health, and is aimed to develop filling techniques for complex polymeric matrices used in regenerative medicine therapies and long-acting injectable (LAI) formulations that release active ingredients over several months. The initiative seeks to improve efficacy in the treatment of serious pathologies such as breast cancer and contribute to the advancement of regenerative medicine.